Recensione del broker ATFX

| 🏦 Deposito Minimo | USD 500 |

| 🛡️ Regolamentato da | FCA, CySEC, FSA-St-Vincent, FSC |

| 💵 Costo di Trading | USD 10 |

| ⚖️ Leva massima. | 30:1 |

| 💹 Copy Trading | Sì |

| 🖥️ Piattaforme | MT4 |

| 💱 Strumenti | Forex, Criptovalute, Metalli, Materie prime, Scommesse a spread |

Ultimo aggiornamento al Agosto 29, 2024

Il 75-90% dei trader al dettaglio perde denaro nel trading di Forex e CFD. Devi valutare se hai capito come funzionano i CFD e il trading con leva finanziaria e se puoi permetterti l’alto rischio di perdere il tuo denaro. Potremmo ricevere un risarcimento quando fai clic sui link ai prodotti che esaminiamo. Si prega di leggere la nostra informativa pubblicitaria. Utilizzando questo sito Web, accetti i nostri Termini di servizio.

Il nostro verdetto su ATFX

ATFX does not onboard clients residing in Italia. The data presented on this page only demonstrates what users in ATFX-accepted geographies can expect from using ATFX. This page in no way can be considered as advertising for this brand on the Deutsch market.

ATFX is a well-regulated STP broker founded in 2017 in London and has expanded rapidly over the last few years. Three account types are offered (including a commission-based Premium Account offering raw spreads), spreads are tight on all accounts but minimum deposits start at 500 USD on the Standard Account. MT4 is the only trading platform supported.

Education is excellent and market analysis is offered by the globally renowned Trading Central. Both deposits and withdrawals are free and a free VPS service is available for traders with higher tier account types.

| 🏦 Deposito Minimo | USD 500 |

| 🛡️ Regolamentato da | FCA, CySEC, FSA-St-Vincent, FSC |

| 💵 Costo di Trading | USD 10 |

| ⚖️ Leva massima. | 30:1 |

| 💹 Copy Trading | Sì |

| 🖥️ Piattaforme | MT4 |

| 💱 Strumenti | Forex, Criptovalute, Metalli, Materie prime, Scommesse a spread |

Riepilogo generale

Informazioni sull'account

Condizioni di trading

Dettagli dell'azienda

Pro

- Ben regolamentato

- Ampia gamma di asset

- Account di Copy Trading

- Buona gamma di account

Controindicazioni

- Solo MT4

- Deposito minimo elevato

Is ATFX Safe?

ATFX is a relatively new CFD broker, founded in London in 2017, but has expanded rapidly in recent years, winning widespread recognition from traders and its industry peers.

ATFX’ subsidiary companies are regulated by a number of different national authorities depending on your location:

- AT Global Markets LLC is a Limited Liability Company in Saint Vincent and the Grenadines with company number 333 LLC 2020.

- AT Global Markets (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom with registration number 760555.

- ATFX Global Markets (CY) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under the license no. 285/15.

- AT Global Markets Intl Ltd is authorized and regulated by the Mauritius Financial Services Commission with license number C118023331.

The company’s subsidiary in the UAE, AT Capital Markets, briefly held a licence from the Abu Dhabi Financial Services Regulatory Authority (FSRA), but this was suspended and the company fined in December 2019 after it was found that the company had been conducting regulated activities before it was granted permission to do so. AT Capital Market’s CEO has since resigned from the company.

Since its inception in 2017, ATFX has won numerous awards including FX Broker of the Year, UK (The European Business Awards 2018), Best Forex CFD Broker (UK Forex Awards 2018), Most Transparent Broker (World Forex Awards 2019) and Best Online Trading Services (ADVFN International Financial Awards 2020).

All ATFX customers, no matter their location, benefit from segregated accounts. In the unlikely event of ATFX insolvency, segregated client funds cannot be used for reimbursement to ATFX creditors.

Overall, we would say that ATFX are a safe broker. It seems the licencing issue with the UAE authorities was an exceptional circumstance and regulatory oversight from the UK’s Financial Conduct Authority means that ATFX must maintain the highest standards of financial propriety.

ATFX Trading Conditions

ATFX is an STP broker, offering high-speed market execution. Because orders are executed on the market, spreads are variable and will depend on liquidity and volatility.

ATFX offers three account types with different trading conditions and deposit requirements. Spreads are relatively tight and, like most brokers, get tighter on the accounts with larger minimum deposits.

Account Types

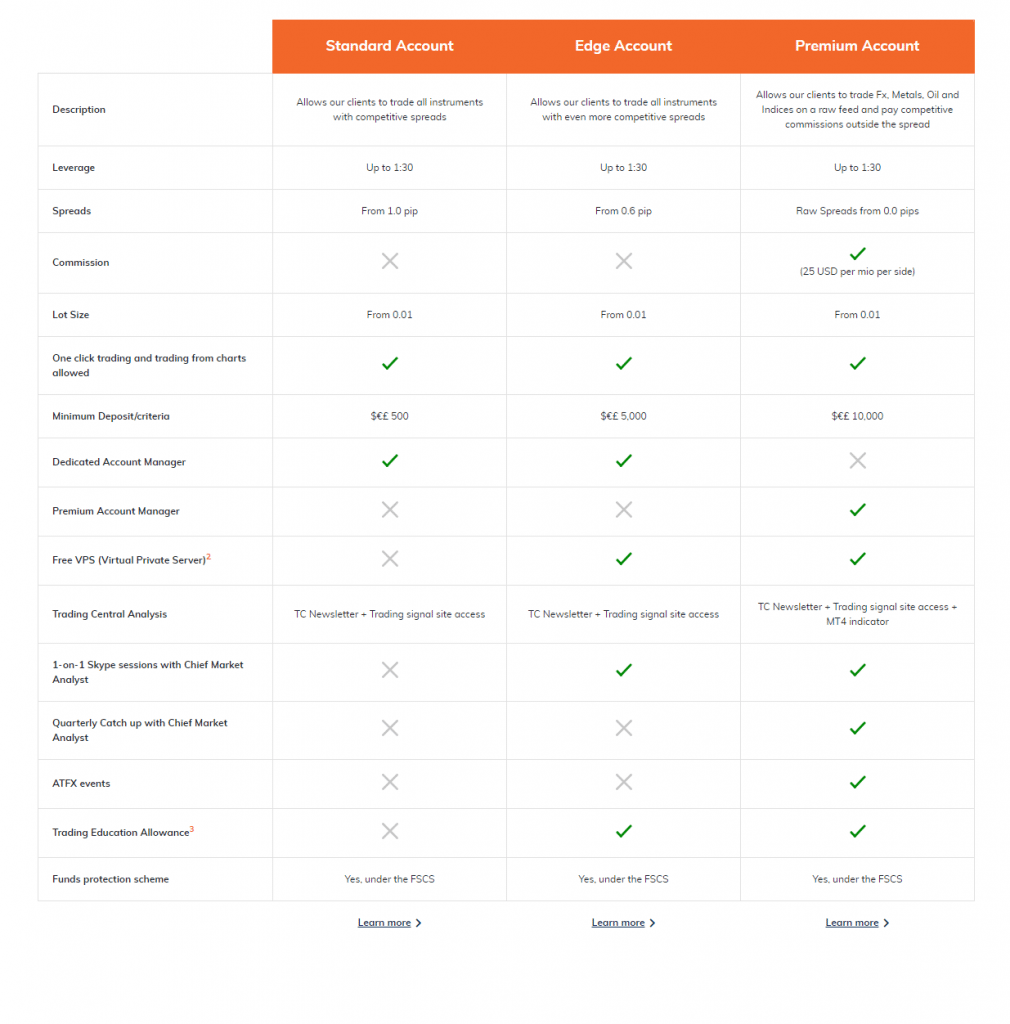

ATFX has three separate accounts types, the Standard, Edge and Raw. While all the accounts offer leverage up to 30:1 and a maximum trade size of 20 lots, they have radically different minimum deposits and spreads.

Standard Account: The Standard Account is ATFX’ smallest account, requiring a minimum deposit of 500 USD. Spreads start at 1.0 pips and a dedicated account manager is provided.

Classic Account: The Edge Account requires a minimum deposit of 5000 USD and spreads start 0.6 pips. Like the Standard Account, a dedicated account manager is provided, along with a free VPS service and Trading Central.

Premium Account: The Premium Account is a commission-based account, providing access to raw spreads from as low as 0 pips. This account requires a minimum deposit of 10,000 USD and commission is charged at 5 USD per lot (2.5 USD per lot, per side). You will also have access to a dedicated Premium Account manager, free VPS and Trading Central.

Spreads and Commission

As mentioned above, spreads are relatively tight at ATFX. Though ATFX does not publish average spreads, the minimum spreads are published for each account. On the Standard Account, minimum spreads on the EUR/USD start at 1 pip and the AUD/USD at 1.1 pips.

Commission is charged only on the Premium Account and stands at 5 USD round turn per lot.

Deposit and Withdrawal

ATFX allows deposits and withdrawals in USD, EUR or GBP and charges no fees for any withdrawal over 100 USD. In the case of bank transfers, your bank may charge you for transfers. Like most brokers, withdrawals can only be made by the same method as the original deposit.

Deposit and withdrawal methods include:

- Visa/Mastercard: Free deposits and withdrawals. Deposits are processed within 30 min, but withdrawals can take 2-5 days.

- Neteller/Skrill: Free deposits and withdrawals. Deposits are processed within 30 min, but withdrawals can take up to 2 days.

- Bank Transfer: Free deposits and withdrawals, though your bank may charge you. Both deposits and withdrawals can take between 3-5 business days.

ATFX for Beginners

ATFX has invested heavily in a comprehensive set of resources for beginner traders. Its education section is well-structured, thorough, and genuinely useful for new traders. Market analysis is also present, though most of the analysis is provided by Trading Central, though this is not really a complaint as Trading Central is probably one of the best providers of market analysis in the world.

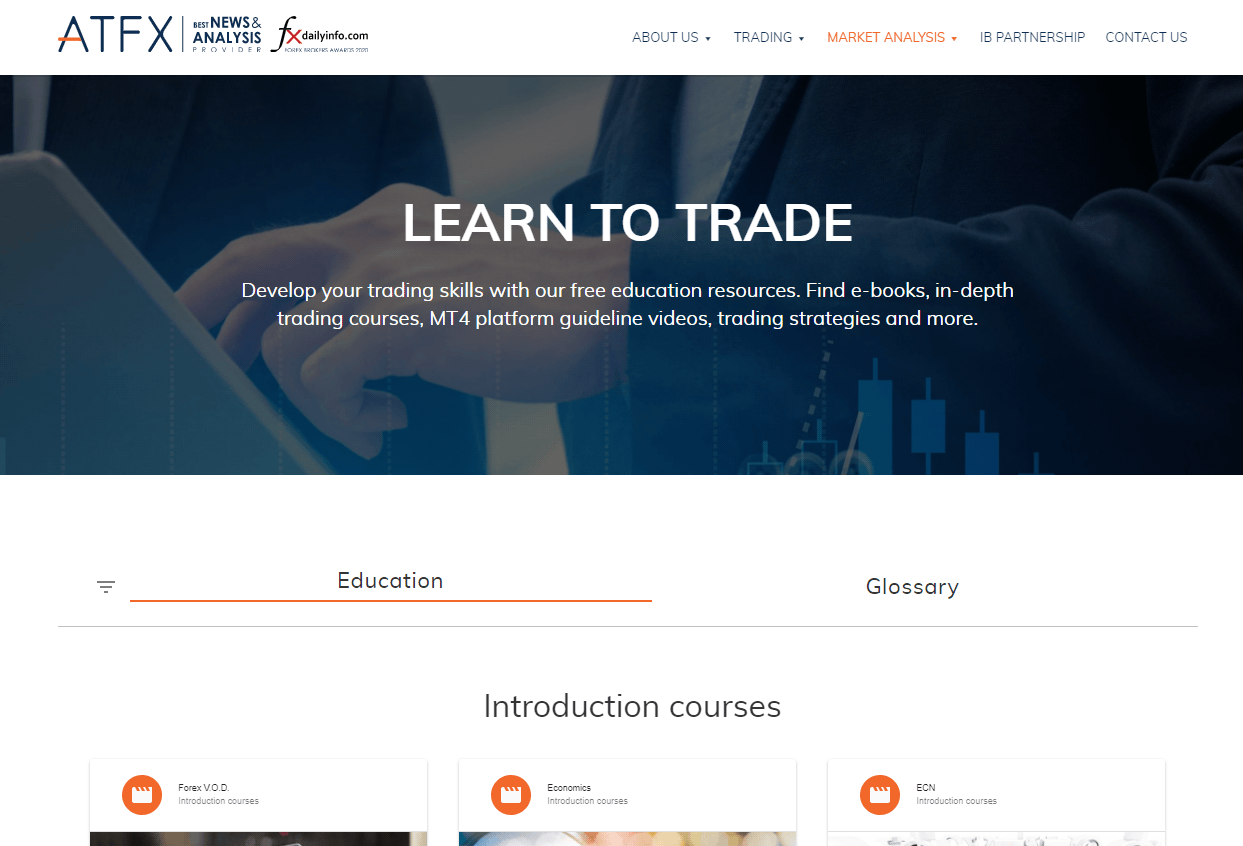

Educational Material

ATFX’s educational material can be found in its dedicated Forex Education Center. Here you will find Introduction Courses, In-depth Courses, and wide range of eBooks.

Introduction Courses: A selection of 6 courses covering Metatrader tutorials, an introduction to global economics and an overview of social trading. More impressive is the library of 28 videos providing a clear and concise introduction to Forex trading.

In-depth Courses: Once you have grasped the basics of the Forex market, this selection of courses is perfect for continuing your education. The cryptocurrency market, trading tools and trading strategies are all covered here.

ebooks: A small library of 14 short eBooks. A range of topics is covered here for those who want a deeper understanding of the topics covered in the courses. Topics include technical analysis, advanced strategies, trading psychology and capital management.

Analysis Material

ATFX has partnered with Trading Central, the world’s best market analysis resource. The technical strategies and professional data provided by Trading Central covers Forex, precious metals, commodities, and indices from sources such as Bloomberg, Thomson Reuters, and Dow Jones. ATFX also hosts video clips of Trading Central analysis, these are updated on an hourly basis.

While all ATFX account holders will have access to Trading Central, only those with Classic, Premium and Raw Account will get full access to Trading Central’s signals library.

ATFX also publishes its own quarterly market outlook, which is available to all visitors just by registering your email address.

Customer Support

Customer Support is available 24/7 via phone, email, and live chat. ATFX does not have a local support team or office in South Africa so the best method of contacting customer support would be via email or live chat.

ATFX Trading Platforms

Currently, ATFX only supports MetaTrader 4 (MT4). The MT4 trading platform is the most widely used Forex trading platform and can also be used to trade other instruments like commodities, cryptocurrency, stock index, and stock CFDs. Though it is now showing its age, MT4 is still popular for its auto trading features that enable algorithmic trading and strategy backtesting with expert advisors (trading robots).

MT4 comes preloaded with over 30 technical indicators while giving traders access to 9 different timeframes and several chart types. A lightweight platform, MT4 has enhanced trading speed, while remaining robust and stable on all systems and even over slower internet connections.

MT4 is available as a desktop download and as a web platform, running in browser. ATFX will also support the MT4 Android and iOS apps, for those who wish to trade on the move.

ATFX Trading Tools

As mentioned above, ATFX has partnered with Trading Central for market analysis, this includes providing traders with Trading Central’s MT4 Analysis indicators. In addition, all ATFX customers gain access to AutoChartist, a powerful pattern recognition tool that monitors all markets to find the best trading opportunities based on real-time technical analysis.

Trading Central

ATFX traders with a Premium Account will get free access to the new Trading Central MT4 Analysis Indicators. This new MT4 trading indicator has been intricately created to make trading easier, intuitive, and more accessible than ever before.

- Receive consistent up-to-date information from analysts you can trust

- Information can be viewed in multiple languages, catering to traders globally

- Stay informed with commentary and analytical forecasts

- Fill order based on Trading Central levels

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the ATFX offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. ATFX would like you to know that: Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74.07% of retail investor accounts lose money when trading CFDs / Spread betting with this provider. You should consider whether you understand how CFDs / Spread betting work and whether you can afford to take the high risk of losing your money.

Overview

ATFX is a relatively new broker, but they have invested heavily in making a solid trading platform. Education and market analysis are strong and spreads are relatively tight compared to other brokers of a similar type, though only the MT4 trading platform is supported. While it is always great to see free deposits and withdrawals, we would also like to see more account types with lower minimum deposits. As it stands, most beginners would be restricted to the Standard Account. It is also a shame that the minimum deposit on the commission-based Premium Account puts it out of reach of most traders.

Team editoriale

Chris Cammack

Responsabile dei contenuti

Chris è entrato a far parte dell’azienda nel 2019 dopo dieci anni di esperienza nel campo della ricerca, della redazione e del design per pubblicazioni politiche e finanziarie. Il suo background gli ha dato una profonda conoscenza dei mercati finanziari internazionali e della geopolitica che li riguarda. Chris ha un occhio di riguardo per l’editing e un appetito vorace per l’attualità finanziaria e politica. Garantisce che i nostri contenuti su tutti i siti soddisfino gli standard di qualità e trasparenza che i nostri lettori si aspettano.

Alison Heyerdahl

Scrittrice finanziaria senior

Alison è entrata a far parte del team come scrittrice nel 2021. Ha una laurea in medicina con particolare attenzione alla fisioterapia e una laurea in psicologia. Tuttavia, il suo interesse per il forex trading e il suo amore per la scrittura l’hanno portata a cambiare carriera e ora ha oltre 8 anni di esperienza nella ricerca e nello sviluppo di contenuti. Ha testato e recensito oltre 100 broker e ha una grande conoscenza del mondo del trading Forex.

Ida Hermansen

Scrittrice finanziaria

Ida si è unita al nostro team come scrittrice finanziaria nel 2023. Ha una laurea in Digital Marketing e un background in scrittura di contenuti e SEO. Oltre alle sue capacità di marketing e scrittura, Ida ha anche un interesse per le criptovalute e le reti blockchain. Il suo interesse per il trading di criptovalute ha portato a un interesse più ampio per l’analisi tecnica e il movimento dei prezzi del Forex. Continua a sviluppare le sue competenze e conoscenze nel trading sul Forex e tiene d’occhio i broker Forex che offrono i migliori ambienti di trading per i nuovi trader.

Confronta i broker

Scopri come ATFX si posiziona rispetto ad altri broker.

Rimani aggiornato

Questo modulo è abilitato al doppio opt-in. Dovrai confermare il tuo indirizzo e-mail prima di essere aggiunto alla lista.